The purpose of the CBDC pilot project outlined in this paper is to explore innovative use cases and business models that could be supported by the issuance of a CBDC.

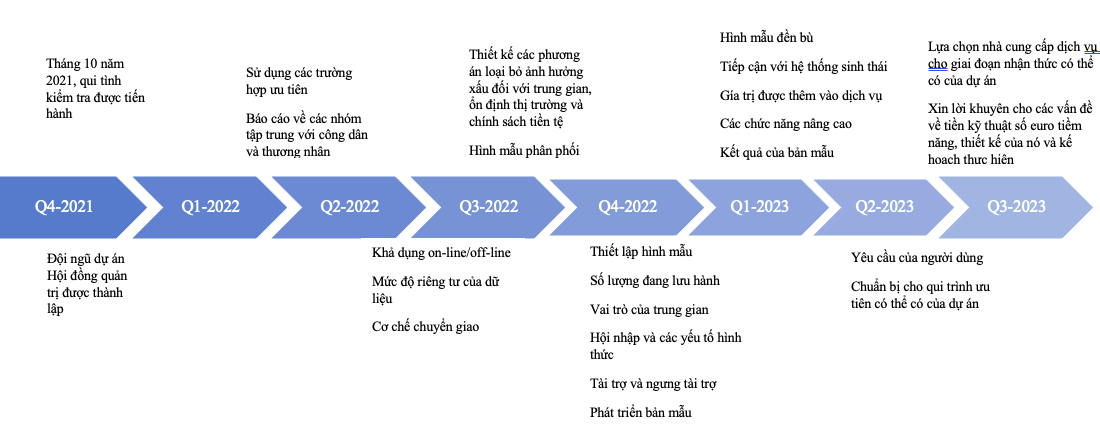

The project will also be an opportunity to further understanding of some of the technological, legal and regulatory considerations associated with a CBDC. The project commenced in July 2022 and is expected to be completed around the middle of 2023.

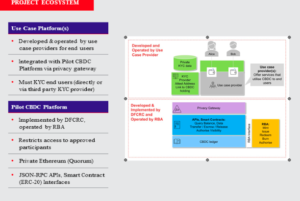

The project intends to test a general-purpose pilot CBDC issued as a liability of the RBA for use in real- world, pilot implementations of services offered by Australian industry participants.6 Any compelling use case – whether so-called ‘wholesale’ or ‘retail’ – will be explored in the project.

All use case proposals submitted by industry participants will be used to inform assessments of the rationale for an Australian CBDC. A limited number of these use cases will also be selected for operation within the CBDC pilot project infrastructure.

The design of the project is intended to be minimally prescriptive – both in the kind of CBDC model assumed, and in the kind of use cases explored. The project is seeking to facilitate ideation and innovation in use cases, and in turn use those results to better understand the case for introducing a CBDC in Australia.

Participation in the project is invited from a broad range of stakeholders, including financial institutions, fintechs, public sector agencies, and technology providers, on use cases of value to them. The RBA and DFCRC are engaged with regulators, such as ASIC and AUSTRAC, to work through regulatory implications as they arise.

Source: Australian CBDC Pilot for Digital Finance Innovation